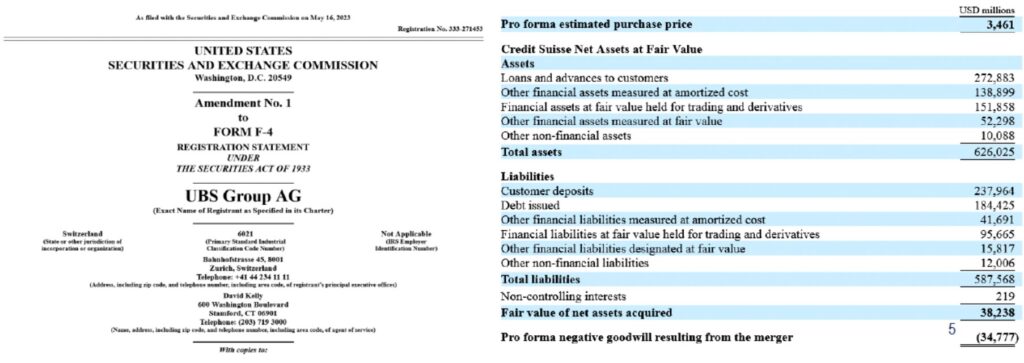

UBS decided to take over Credit Suisse for CHF 3 billion (or CHF 0.76 per share) on March 19, 2023, whereas just two months later it valued the company at CHF 34 billion (or around CHF 8.68 per share) in its merger announcement to the US financial regulator on May 16, 2023.

At the close of stock market on Friday March 17, 2023, Credit Suisse was still worth at least CHF 7 billion, or CHF 1.86 per share.

Credit Suisse has been sold below its market price – UBS valued it at around CHF 34 billion, or 10 times the price paid to shareholders…

Value of Credit Suisse at the close of trading on March 17, 2023

Acquisition of Credit Suisse

by UBS on March 19, 2023

Valuation of Credit Suisse

by UBS in May 2023

Join the Swiss Association for the Defense of Shareholders (ASDA), led by three Geneva law firms, in coordination with a Zurich law firm, who have brought an action before the Zurich Commercial Court.