For this action, the legal costs are calculated on the basis of the entire share capital of the absorbed company. In our case: between a minimum of 3 billion Swiss francs and a maximum of 30 billion Swiss francs.

Except for a few very wealthy shareholders, these costs, plus legal fees, make the possibility of such a legal action illusory.

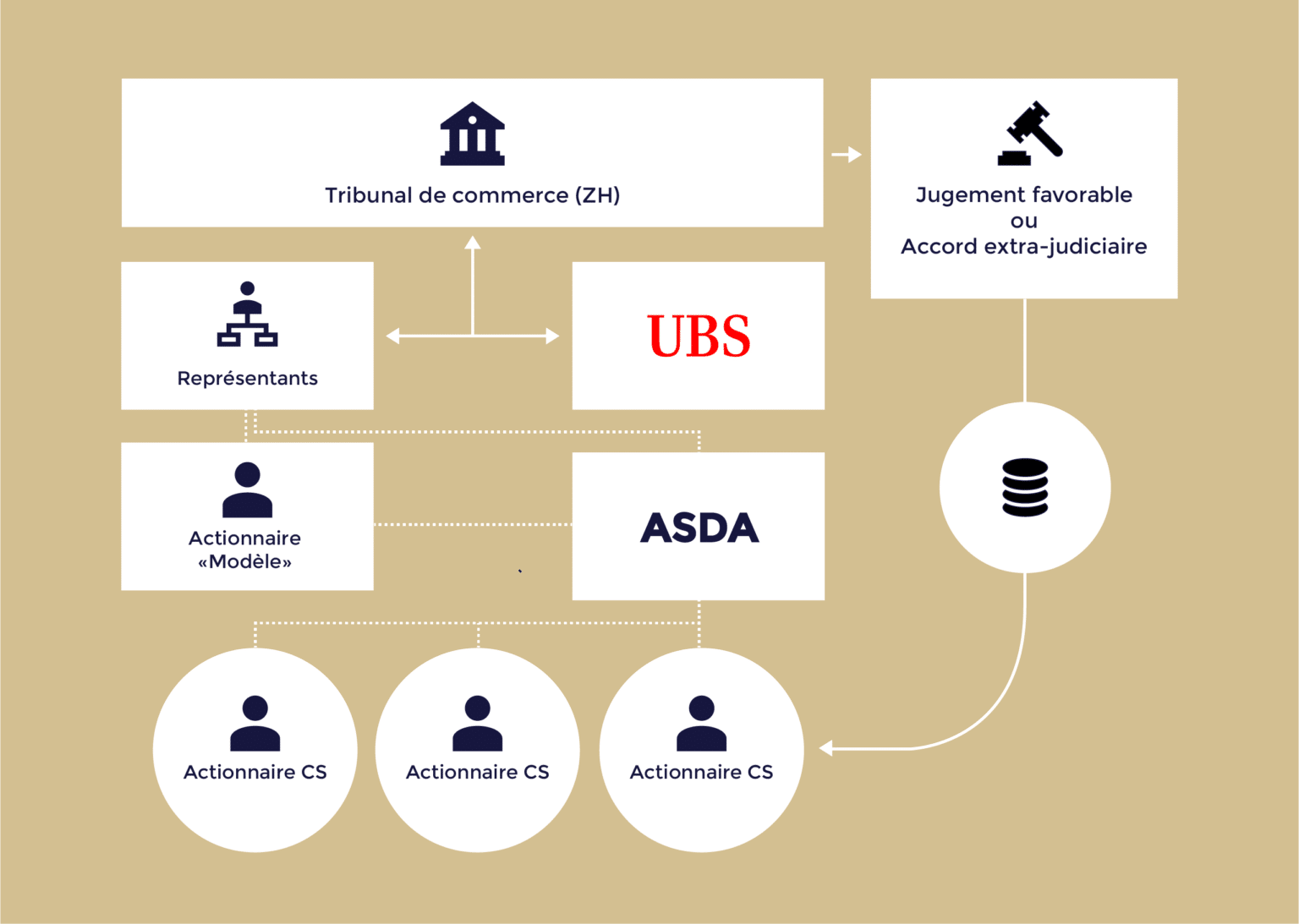

However, the class action mechanism allows participants to benefit from the advantages of a single action filed by one model shareholder, without incurring the risks.

Only the “model shareholder” claimant is subject to this risk, since he or she is the only one to have filed the action.

Under certain conditions, the “model shareholder” is entitled to allow other shareholders to benefit from his action.

Three Geneva law firms, in collaboration with one Zurich law firm, brought an action before the Zurich Commercial Court.

In response to strong demand from (ex-) Credit Suisse shareholders who have not yet taken part in such an operation, ASDA has decided to open up the possibility of joining this action to other shareholders.